How to Start Selling on Amazon: A Complete Handbook

Step 1: Research and Plan Your Amazon Business

Identify Profitable Products and Niches

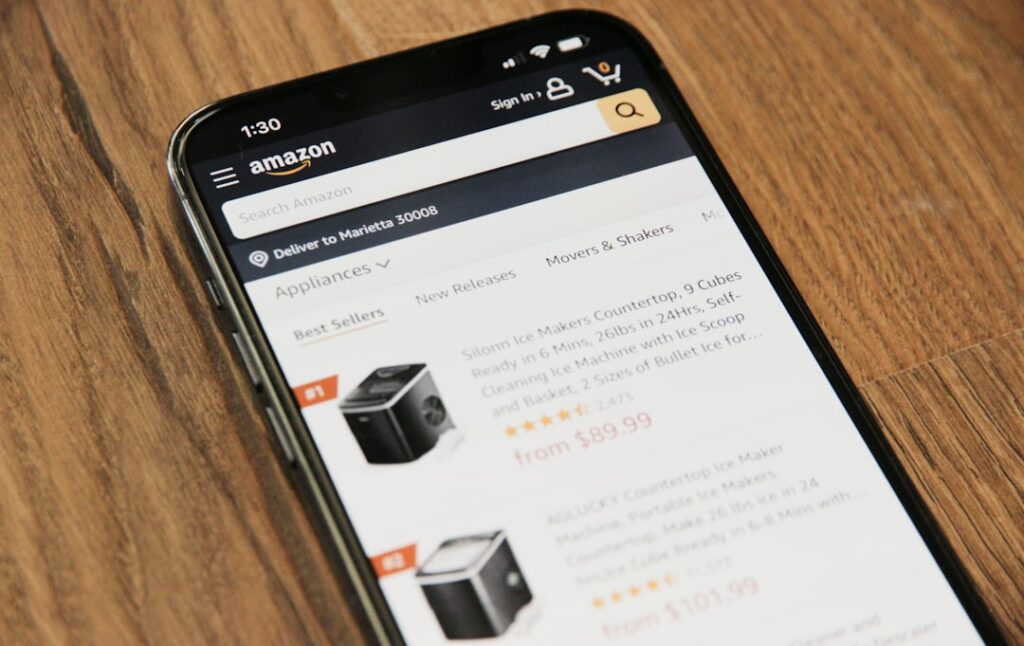

To begin, delve into product research using tools like Jungle Scout, Helium 10, or Keepa. Look for products with a high demand (indicated by strong sales rank history) and moderate competition. Analyze Best Seller Ranks (BSRs) within specific categories; a consistently low BSR (e.g., under 5,000) suggests high sales volume. Consider products that solve a common problem, offer a unique selling proposition, or cater to an underserved niche. For instance, instead of selling generic phone cases, explore niche accessories like ergonomic phone grips for gamers or waterproof cases for specific outdoor activities. Pay attention to product dimensions and weight, as these significantly impact shipping costs and FBA fees. Aim for products that are lightweight and compact to minimize fulfillment expenses.

Understand Amazon’s Selling Fees and Policies

Before committing to a product, thoroughly review Amazon’s fee structure. This includes referral fees (a percentage of the sale price, varying by category, typically 8-15%), fulfillment fees (if using FBA, based on product size and weight), monthly storage fees (for FBA inventory), and subscription fees for a Professional selling plan. Access the “Selling on Amazon Fee Schedule” on Seller Central to get precise figures for your target categories. Familiarize yourself with Amazon’s restricted product categories and intellectual property policies to avoid listing violations. For example, certain health supplements or electronic devices may require specific certifications or approvals. Understanding these policies upfront will prevent costly setbacks.

Step 2: Set Up Your Amazon Seller Account

Choose Your Selling Plan (Individual vs. Professional)

Amazon offers two primary selling plans: Individual and Professional. The Individual plan is suitable for sellers expecting to sell fewer than 40 units per month, as it charges a $0.99 fee per item sold. The Professional plan, priced at $39.99 per month, is ideal for sellers exceeding 40 sales monthly, offering additional features like eligibility for the Buy Box, bulk listing tools, and access to advanced reports and APIs. If you are serious about building a sustainable business, the Professional plan is almost always the more cost-effective and feature-rich option in the long run. You can upgrade or downgrade your plan at any time.

Gather Required Documentation and Information

Before registering, ensure you have all necessary documentation readily available to streamline the setup process. This typically includes: a valid, internationally chargeable credit card (not a debit card), a government-issued national ID (e.g., driver’s license or passport), a tax information interview (for U.S. sellers, this involves providing your Social Security Number or Employer Identification Number), and a phone number where you can be reached. Amazon will also require bank account information for disbursements. Ensure the name on your bank account matches the name on your Amazon seller account for verification purposes. Having these documents prepared in advance will prevent delays in account approval.

Step 3: Source and List Your Products

Find Reliable Suppliers and Manufacturers

Identifying trustworthy suppliers is crucial for your Amazon business. For private label products, platforms like Alibaba.com are popular for finding manufacturers, but thorough due diligence is essential. Request samples from multiple suppliers to assess product quality before placing a large order. Verify their production capacity, lead times, and quality control processes. For reselling established brands, consider working directly with authorized distributors or wholesalers to ensure authenticity and competitive pricing. Always get written agreements or purchase orders detailing specifications, pricing, payment terms, and delivery schedules. Building long-term relationships with reliable suppliers can significantly impact your profitability and consistency.

Create Optimized Product Listings with High-Quality Images

A compelling product listing is vital for attracting customers and driving sales. Your product title should be keyword-rich, including the brand, product name, key features, and quantity (e.g., “Brand Name Ergonomic Office Chair with Lumbar Support – Adjustable Height & Armrests – Black”). Utilize all available bullet points to highlight key benefits and features, addressing potential customer questions. Write a detailed product description that tells a story and expands on the bullet points, using HTML formatting for readability if you have a Professional account. Most importantly, invest in professional, high-resolution product images. Include at least 7-9 images: a main image on a pure white background, lifestyle shots showing the product in use, images highlighting features, and scale images. High-quality images significantly increase conversion rates.

Step 4: Manage Orders and Grow Your Business

Implement Effective Inventory Management Strategies

Efficient inventory management prevents stockouts and overstocking, both of which can harm your profitability. Use Amazon’s inventory planning tools in Seller Central to monitor your stock levels, sales velocity, and reorder points. Set up automated alerts for low stock. For FBA sellers, understand Amazon’s storage limits and long-term storage fees to avoid unnecessary costs. Implement a “first-in, first-out” (FIFO) system for products with expiration dates or those prone to obsolescence. Regularly review your sales data to forecast demand accurately and adjust your purchasing and shipping schedules accordingly. Tools like InventoryLab can provide more granular insights and help manage profitability.

Utilize Amazon’s Fulfillment Options (FBA vs. FBM)

Amazon offers two primary fulfillment methods: Fulfillment by Amazon (FBA) and Fulfillment by Merchant (FBM). With FBA, you send your products to Amazon’s fulfillment centers, and they handle storage, picking, packing, shipping, customer service, and returns. This can save significant time and resources, and FBA products are eligible for Prime shipping, often boosting sales. However, FBA incurs fees (storage, fulfillment). With FBM, you store, pick, pack, and ship products yourself. This gives you more control over the fulfillment process and can be cheaper for low-volume or oversized items, but requires more operational overhead and you must meet Amazon’s strict shipping performance metrics. Many sellers use a hybrid approach, using FBA for bestsellers and FBM for slower-moving or specialty items.

FAQs

Q: How long does it take to get approved to sell on Amazon?

A: Account verification can vary. Typically, it takes a few days to a couple of weeks, depending on how quickly you provide the required documentation and how busy Amazon’s verification team is. Ensure all submitted documents are clear, current, and match the information you provided during registration to avoid delays.

Q: Can I sell products that are already available on Amazon?

A: Yes, you can. If the product already has an existing listing, you will “list against” that ASIN (Amazon Standard Identification Number). This means you’ll add your offer to the existing product page. However, ensure your product is an exact match in brand, color, size, and other specifications. If it’s not an exact match, you must create a new product listing.

Q: What are the biggest challenges for new Amazon sellers?

A: Common challenges include intense competition, managing inventory effectively, dealing with negative reviews, understanding and adapting to Amazon’s constantly evolving policies, and initial capital investment for inventory and marketing. Building a strong brand and providing excellent customer service are key to overcoming these.

Q: Do I need a business license to sell on Amazon?

A: While Amazon itself doesn’t explicitly require a business license to open a seller account, your local, state, or federal government might. It’s highly recommended to consult with a legal or business professional to understand the specific licensing and tax requirements for operating an e-commerce business in your jurisdiction.